The IRS Form 1098-T reports amounts billed to you for qualified tuition and related expenses, as well as other related information. You, or the person who may claim you as a dependent, may be able to take the tuition and fees deduction or claim an education credit on Form 1040 or 1040A for the qualified tuition and related expenses that were actually paid during the calendar year. IRS Form 1098-T is an information return and does not need to be attached to your tax return.

For example, a student who makes payment in 2016 for Spring 2017 charges will only be eligible for an education credit for this payment in 2016.

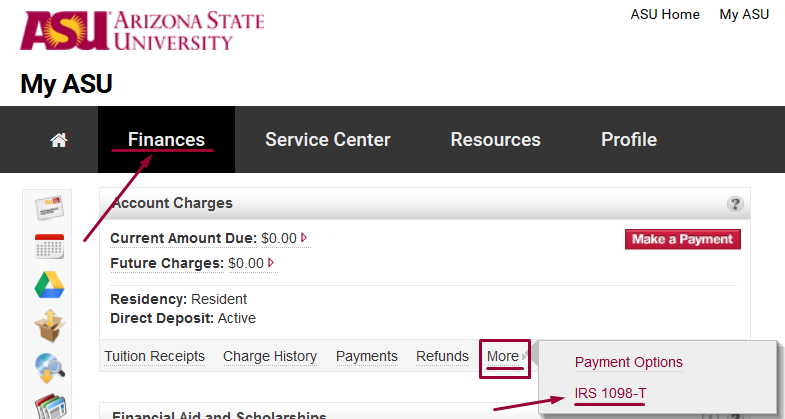

To view your 1098-T Tuition Statement, please follow the steps below.

- Log in to My ASU

- Select the Finances tab at the top of the page

- Click on More and select 1098-T to view your Tuition Statement

Please note:

- The 1098T is a legal tax document that is only accessible by the student. Parents must obtain this form from their student. Please call 480-965-9834 if your Social Security Number on your 1098-T is incorrect.

- There is no IRS requirement that you claim a tuition and fees deduction or an education credit. Please consult your tax advisor for further tax questions or advice.

Please see the IRS Form 1098-T FAQ's for additional information.